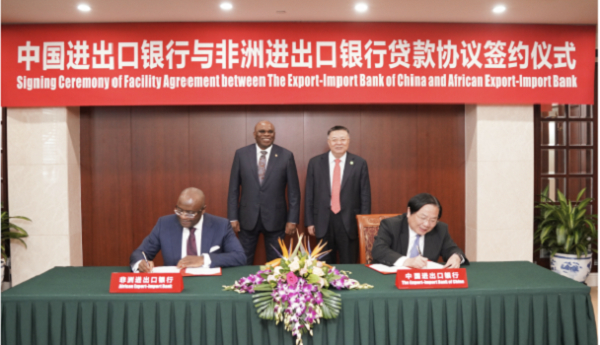

The purpose of the loan is to facilitate and finance the trade and economic cooperation between the member states of Afreximbank and the People’s Republic of China (PRC). The loan will also aide in promoting the financial cooperation between Africa and the PRC.

Speaking during the meeting and signing ceremony, Prof. Oramah noted that it is fortuitous that the signing of this important facility coincides with the 10th anniversary of the Belt and Road Initiative (BRI). This is strong evidence of the rapid growth in cooperation between China and Africa. Noting that the BRI is a blueprint of cooperation aimed at enhancing policy, trade infrastructure, financial and people-to-people connectivity, as a bank we are committed to play a big role especially of leveraging financial resources into Africa. This facility will help to catalyse trade financing between Africa and the PRC, thereby enhancing flow of goods, capital and technology.

He added that through its 6th Strategic Plan, which runs from 2022 to 2026, Afreximbank is working diligently to broaden its role in African trade finance and continues to see lots of collaboration opportunities on the continent. Working with partners like CEXIM, we aim to attain the goals of this strategy, especially supporting China-Africa Cooperation and expanding Africa’s export manufacturing capacity.

Mr. Shengjun Ren, President of CEXIM, noted the signing of the agreement as a concrete measure taken by CEXIM in fulfilling its due responsibilities to promote high-quality BRI cooperation and to implement the nine programs under the Forum on China and Africa Cooperation framework. It is also an important example of third-party market cooperation carried out by CEXIM.

The two sides agreed to take the signing of this agreement as an opportunity to strengthen cooperation in various areas including credit business, equity investment, capital market operations, trade finance, personnel exchange and knowledge sharing, so as to make positive contributions to China-Africa economic cooperation and trade as well as sustainable economic and social development of African countries.

- ENDS -

About CEXIM

Founded in 1994, CEXIM is a state-funded and state-owned Chinese policy bank dedicated to supporting China’s foreign trade, investment, and international economic cooperation. With the Chinese government’s credit support, the Bank plays a crucial role in promoting steady economic growth and structural adjustment, supporting foreign trade, and implementing the “going-global” strategy.

CEXIM is rated by Standard & Poor's, Moody's Investors Service, and Fitch, as A+, A1, and A+ respectively, same as China's sovereign ratings. By the end of 2022, CEXIM had a total asset of USD 852.45 billion, covering businesses in credit, trade finance, financial market, equity investment, etc... CEXIM has 32 domestic branches, 1 representative office in Hong Kong SAR, and 6 overseas institutions.

More information about CEXIM: http://english.eximbank.gov.cn

About Afreximbank:

African Export-Import Bank (Afreximbank) is a Pan-African multilateral financial institution mandated to finance and promote intra-and extra-African trade. For 30 years, the Bank has been deploying innovative structures to deliver financing solutions that support the transformation of the structure of Africa’s trade, accelerating industrialization and intra-regional trade, thereby boosting economic expansion in Africa. A stalwart supporter of the African Continental Free Trade Agreement (AfCFTA), Afreximbank has launched a Pan-African Payment and Settlement System (PAPSS) that was adopted by the African Union (AU) as the payment and settlement platform to underpin the implementation of the AfCFTA. Working with the AfCFTA Secretariat and the AU, the Bank is setting up a US$10 billion Adjustment Fund to support countries to effectively participate in the AfCFTA. At the end of 2022, Afreximbank’s total assets and guarantees stood at over US$31 billion, and its shareholder funds amounted to US$5.2 billion. The Bank disbursed more than US$86 billion between 2016 and 2022. Afreximbank has investment grade ratings assigned by GCR (international scale) (A), Moody’s (Baa1), Japan Credit Rating Agency (JCR) (A-) and Fitch (BBB). Afreximbank has evolved into a group entity comprising the Bank, its impact fund subsidiary called the Fund for Export Development Africa (FEDA), and its insurance management subsidiary, AfrexInsure, (together, “the Group”).